YUX is a Human Centered Design company based in Senegal. After quite a few digital finance and agriculture projects undertaken around the African continent in 2018, we wanted to share with you the main insights we have seen designing and testing fintech apps in Africa.

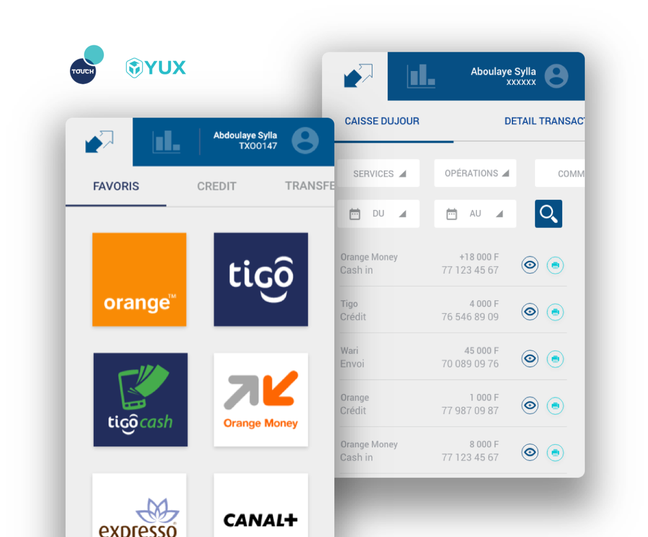

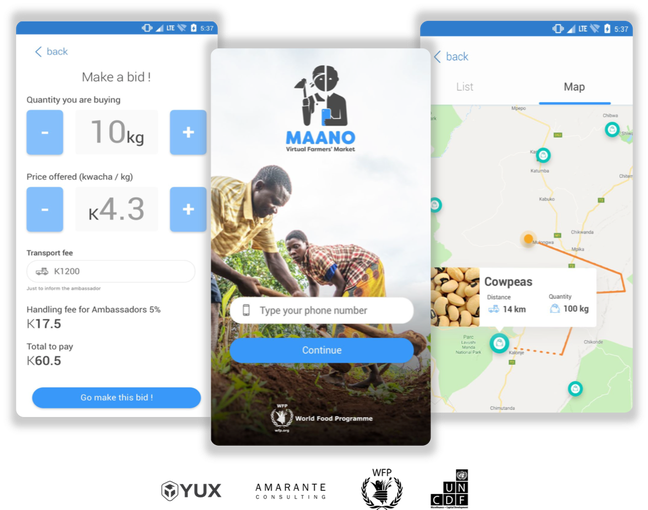

Indeed, 2018 was a pretty hectic one for YUX. After spending our first year (2017) doing mostly UX-UI work for telcos and fintech in Senegal, we had the chance in 2018 to do impactful user research, user testing and co-creation projects for various organizations all over the continent. We worked with Fintechs (InTouch), Telcos (Orange, Airtel-Tigo), Microfinance institutions (Microcred), construction companies (Lafarge) and development organisations (GSMA, WFP, UNCDF, USAID) in Senegal, Côte d’Ivoire, Zambia and Rwanda. Here are few of our thoughts for designers, product managers and international development executives.

Put the people first and understand their communities

It will sounds cheesy maybe but it’s worth repeating that people in Africa are very, very different from one country or region to the other. You will find for instance that in Senegal several farmers have a basic smartphone and that in Rwanda a lot of them don’t have any device but carry their SIM card with them! That is why it is very important that your team of designers spend as much time as possible immersed with their users and try different human centered design approaches to co-create with them. We have noticed for instance that in some countries, discussion groups work better than individual interviews, or that storytelling with icons was more powerful than the classic semi-directive interview. We also learned to be very careful about the cultural sensitivity around some topics like family planning or money management. It is always better to come with an experienced user researcher who understands the context and who can build trust with the user, ideally by sharing their language, religion, culture, gender, age, etc. Finally, communities and ecosystems are crucial in the decision processes of the people. It is common for individuals to reject an innovation because they don’t know if it can harm their larger community. We met with farmers who wanted to receive their salaries via mobile money — but who decided as a group not to do so because it could disrupt their local cooperative bank.

Keep it simple — forget about the bank app you had in the US

Most users unSub-Saharan Africa are still pretty new to technology and like you will see in our recent study of digital behaviours in Senegal, a lot of people prefer large fonts, simple screens, local icons and images with real people. Which means that you really have to make an important effort to simplify as much as you can your interface and user experience. You’d rather start with a very light MVP and add features little by little. That may be the hardest part though — since a lot of various stakeholders from your organisation or your partners generally want to be part of the project and then your struggle will be choosing what your app should do. In this sense, organizing one or several design sprints of at least 4 days at the beginning of the project is hugely valuable. We experienced that notably in our missions with telecom operators Orange Cote d’Ivoire and Orange Senegal notably when working on the design of the new Orange Money App. Those endeavours always involve a lot of people and you’d rather make sure that everybody agrees on the same vision and UX strategy right at the beginning.

Create specific products for the informal sector — don’t try to fit it in your B2B or B2C

Generally large companies are structured so that they can address in unique ways the mass market (B2C) and the businesses (B2B). However, in most African countries, you may find that a large part of your market is actually comprising of small businesses, often labelled as the “informal economy”. Business executives are often tempted to consider them either as very small businesses and address them with their B2C sales and product teams or to consider them like formal companies and address them with their business services department. The truth is that those businesses can sometime be pretty big and have a lot of staff to manage, a lot of providers to pay, export and import internationally, etc. while still being very informal and tech averse for technical of fiscal reasons. On the other hand, the rest of these entrepreneurs that are very small still have business needs and don’t want to be treated like end users. Like we learned building an app for Street Vendors, they want some aggregated and high level reporting on their various activities, they want to easily reach out and order from their providers, they want to be connected with similar entrepreneurs and negotiate better buying price, they want marketing and loyalty tools to reach out to their customers, etc. But the small ones do not seem to want POS system like we would love to sell to them to collect relevant data points : the inventory is just to hard to build and they generally don’t have time to use it in front of the customer.

Localized Icons and wording are essential

Like we detailed in our recent human centered design project with Farmers in Zambia, it is essential to create icons that reflect the daily life of your users. The icon of a hand with a dollar bill, internationally used to represent “payment”, was understood as “smartphone” by the users and the notifications bell for them only relate to cows ! Moreover, you may find in some African countries (Zambia and Rwanda for instance) people that can read and write in English or their local language very well, but who are new to digital. Naturally, words like “login”, “Delete” or “edit” actually do not mean much for them so make sure you test all the wording of your products.

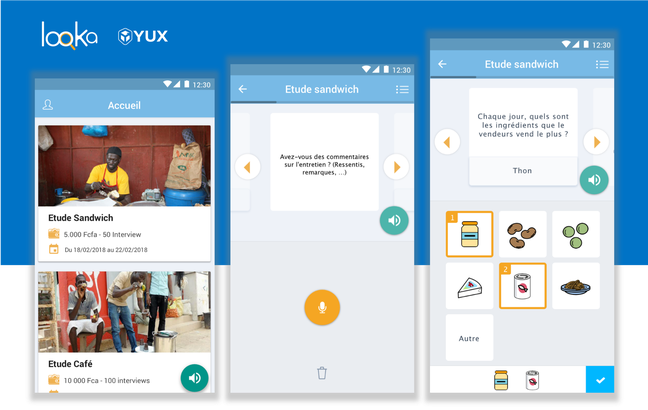

If possible use vocal and audio to help your users

Like we prototyped and tested in Looka — our app to run market research about the informal economy — the use of vocal helpers is largely appreciated by the users, notably the ones who can not read easily (French or Wolof or any other language). Those simple buttons, placed on the side of each key elements of the screen, display a small audio file recorded in several languages and defined in the app settings. It really helps people understand clearly what the interface is “saying”, especially when they are on the move in our hectic African cities !

We hope these insights from the field will help you co-create with your users, digital products that are more relevant to their contexts and natural behaviours. Looking backward, companies start now to understand that the former approach of pushing products thought and built for the western world can not succeed in Africa — even with a ton of PR and marketing. However, high-growth start-ups and agile corporates are now demonstrating that localized UX and product strategy can bring fast return on investment and dramatically increased customer adoption and referral. As the market becomes used to such methods and services, we see a larger opportunity everyday to build meaningful digital tools for Africans.